The Economics of Domain Investing

Domain name investing seems easy. We’ve all read stories about the person who registered a great domain in the 1990s and sold it for millions of dollars decades later.

Even the small wins seem great. It’s not unusual for someone to buy a domain name for $100 and sell it for 25 or 50 times as much. Any domain investor will tell you about the rush they get when they sell a domain at a nice profit.

But the activity of selling a domain name for a profit can mask the hidden truth: while selling an individual domain can drive a profit, investing in domain names isn’t as easy as it seems. It requires a lot of upfront capital to build a portfolio of domain names to sell and takes a long time to sell them.

The Costs of Domain Investing

Domain investors have three big costs:

- Cost of acquiring domain names. This includes what they pay to hand register domains (register domains that are not currently registered), buy expired domains in auctions, and buy premium domains from others.

- Renewal fees. These are nominal but add up as your portfolio grows.

- Time. What could the domain investor do with their time if they didn’t spend it researching, buying and selling domains?

While the costs of acquiring domains and the renewal fees are easily quantifiable, investors should also consider how much they could earn with their time if they did something other than invest in virtual real estate. Few take this into consideration, even though it’s a big cost.

Domain Investing Metrics

In order to figure out the economics of domain investing, investors need to track the following metrics.

- Acquisition costs.

- Ongoing renewal costs.

- Average selling price. If you sell five domains for $10,000 total, the average selling price is $2,000.

- Sell-through rate. The percentage of the domain portfolio that is sold in a given year.

- Cost of your time.

Digging into these numbers will pop any dream of domain investing as being on easy street.

Running the Numbers

Consider the following domain investor building a portfolio and optimizing their portfolio for sale.

- Acquisition costs – The investor acquires domains for an average of $100 through expired domain auctions.

- Renewal costs – about $10 per year per domain.

- Average selling price – $2,500 per domain, which is in the “sweet spot” for aftermarket domain sales.

- Sell-through rate – A well-optimized, fairly-priced portfolio can sell about 1%-1.5% of domains per year. If the investor owns 1,000 domains, they can expect to sell 10-15 per year at these rates.

Let’s say this investor buys 25 domains per month at the average acquisition price. They do a great job buying the right domains and listing them for sale, achieving a 1.5% sell-through rate (selling 1.5% of their domains per year).

Guess how many months it would take for them to become cash flow positive each month?

About 44.

Yes, it would take nearly four years with these results in order to start getting paid each month rather than coming out of pocket. This doesn’t even consider the cost of their time.

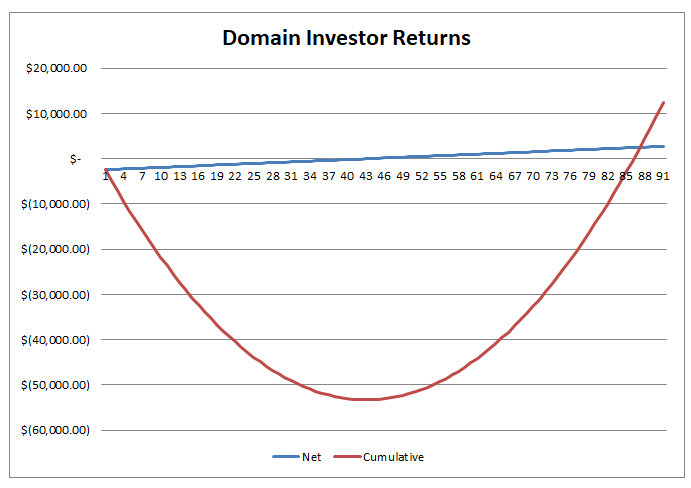

And their overall venture will continue to run a deficit from all of those early investing years until they’ve invested for over 7 years. Here’s a chart that shows this, with the x-axis representing the number of months:

To be fair, this analysis simplifies things a bit. It assumes some sales of domains from the first month, so it includes fractions of domains sold each month to smooth it out. It also spreads renewal fees across the portfolio from the start.

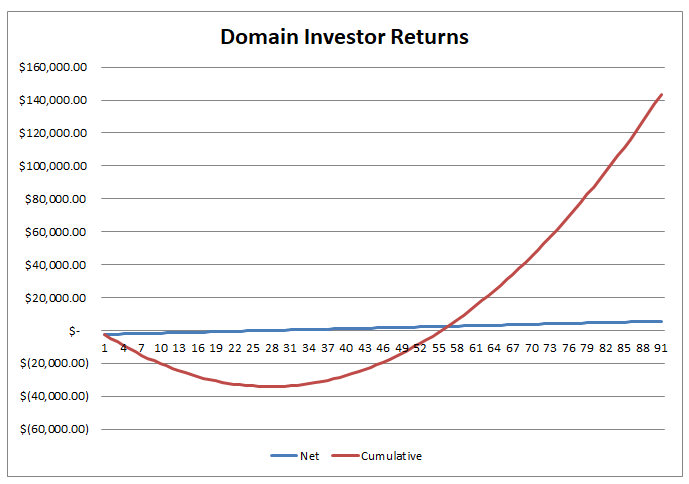

Of course, if you can improve any of the metrics, the results are much better. Sell domains at an average of $3,500 and the investor is cashflow positive each month starting around month 30.

This chart shows how returns can grow nicely after a long period of time. Part of the challenge is the acquisition cost of buying so many domain names. This is a true investment. A domain investor can step on the breaks and stop buying new domains to get a higher cash flow, but eventually their domain inventory needs to be replaced.

Compare this to buying a rental property. If you pay cash (like you usually do for domains), you pay many years worth of rent up front and earn it back over time. Domain investing is similar. The difference is that real estate investors usually finance their purchase, so they can immediately get positive cash flow between how much they charge and how much they pay the bank each month.

From Hypothetical to Reality

These examples are hypothetical but based on common domain investment strategies. Some investors undertake different tactics, such as buying higher-value domains and doing outreach to sell them. The economic picture is very different for these sellers than ones that build up a portfolio made up of expired domains.

And some investors are really good at buying the right domains at the right price, so results may vary.

The important thing is for you to think about your long-range plan and how your domain purchases today fit into that plan. Are you willing to go in the red for many years until you make back your money? Or should you focus on acquiring key domain names that you can actively sell to achieve a greater sell-through rate?

Domain investing can be fun and profitable. A bit of advanced planning and forecasting goes a long way.